What is a sales tax?

Sales tax is a US sales tax. When buying American goods, in addition to the cost of the item itself, the buyer must pay a tax on the purchase. The tax is levied at the point of sale: offline or online store.

The sales tax goes to the budget of the state where a certain thing is bought. It is calculated and added to the cost of the purchase by the store where the goods are bought.

So, when buying online, the seller will withhold tax in favor of the state where the buyer is located. For example, if a purchase is shipped to an address in Illinois, the buyer will be charged the amount required by the laws of that state.

Sales tax is charged:

- offline purchases: if the store is located in the state of the buyer;

- from online purchases: if the buyer has a warehouse, an offline store or a local office of the seller.

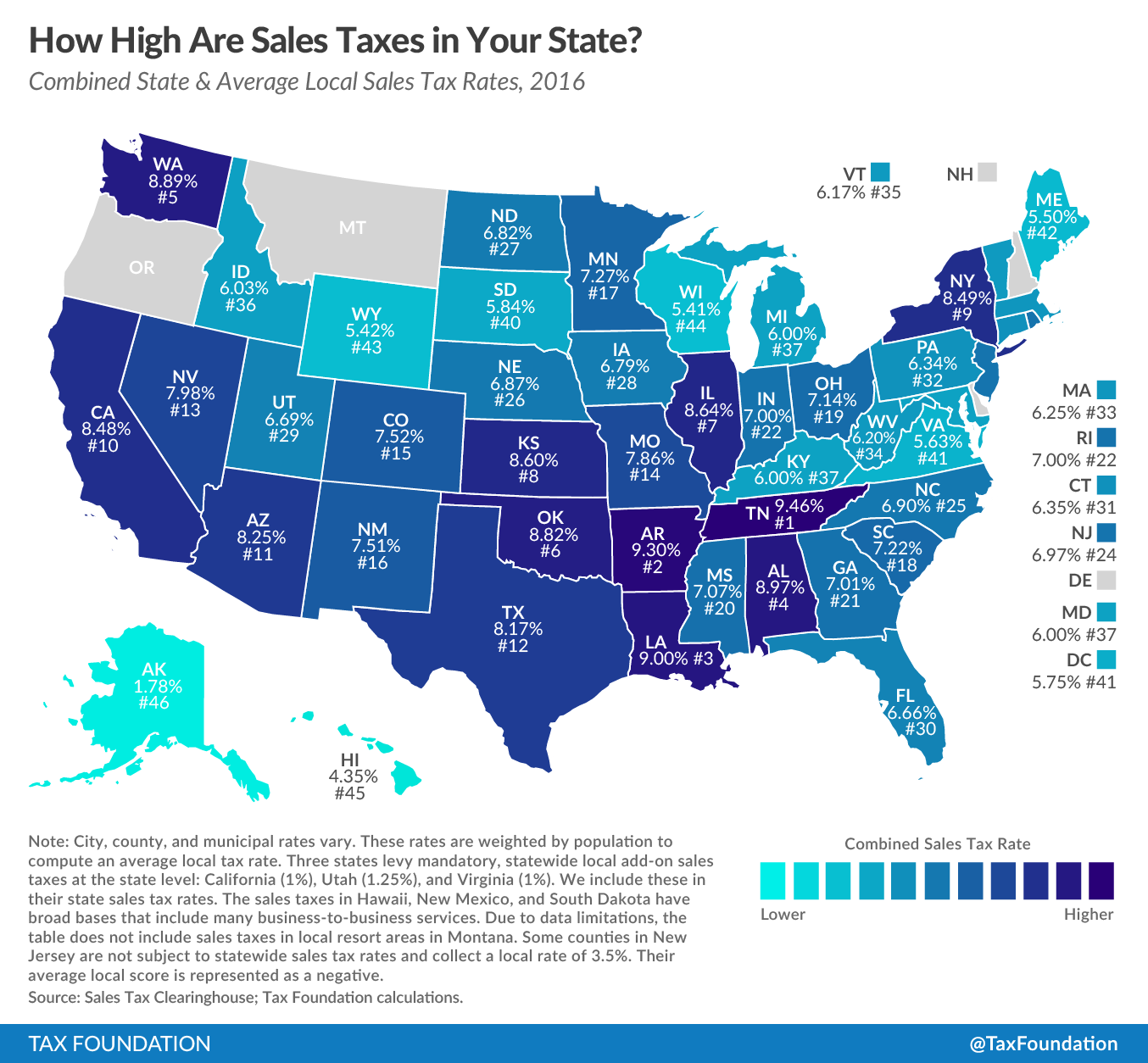

Each state has its own tax rate. Usually it is calculated as a percentage of the value of the goods. US law exempts certain goods and services from this tax. Therefore, the amount and availability of tax must be clarified before buying. The tax can be up to 12% of the purchase amount.

Is it possible not to pay tax

US Stores are legal entities registered under the law. And they carry out their activities in accordance with the laws. Therefore, it will not be possible to avoid paying the tax. The buyer can look for a store that does not charge sales tax - Amazon, eBay. Such platforms carry out all their activities online, they do not have physical outlets. Therefore, there is no sales tax here. When making a purchase through our website, you will find out in advance whether there is a sales tax in your particular case and what it will be. When a purchase is added to the cart on the site, the store automatically calculates the tax amount. It is paid with the purchase. Send us a link to the product you like, and we will calculate the final price in an hour, taking into account taxes, shipping and customs nuances.

Why sales tax is not scary

At its core, the American sales tax is the same VAT (value added tax that is levied on every purchase you make in a Ukrainian store). The difference is that in the US it is 1-12%, and in Ukraine - 20%. Therefore, buying abroad is more profitable, even taking into account shipping, taxes and customs fees:

- directly without overpayments to intermediaries;

- sales, discounts up to 90% and Black Friday;

- only original products.

The OrderWorld team makes it profitable for you to buy abroad — we have flexible delivery rates, our own warehouses in America and Europe, and free delivery across Ukraine by Nova Poshta.

No comments at the moment